An integrated solution with proven scalability

Fundrbird automates fund management across fund accounting, reporting, compliance and portfolio modules. Every calculation, workflow and report is powered by a single dataset. So your fund can enable BI tools and AI models using clean, consistent and well‑organized data. With intuitive UX and proven scalability across complex fund structures, we help you maintain operational excellence.

Fund accounting

The Fund accounting module is designed to manage complex fund structures. This includes Main, Parallel, Feeder, Subsidiaries and SPV vehicles.

Closings & transfers

Manage closings with automated rebalancing, interest calculations and true-up entries. Allocation rules automatically adjust to changing investor commitments.

Bank transactions & period-end

Connect bank accounts via API to automate cash journal entries. A guided checklist ensures every step toward NAV reconciliation is accurate and complete.

General ledger

Record all accounting entries through easy workflows with each transaction stored in an immutable general ledger - everything from simple bank charges to intercompany postings.

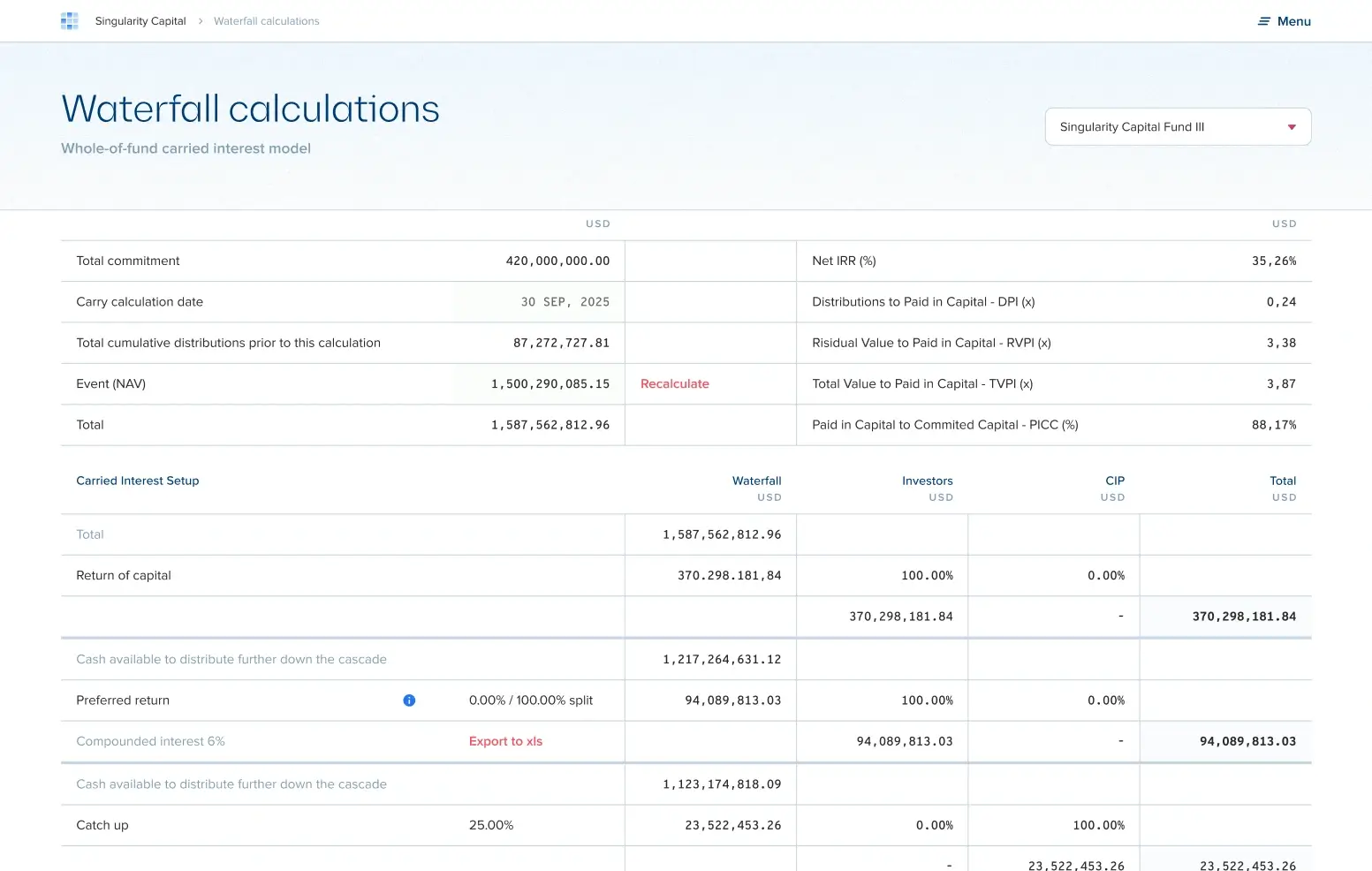

Waterfall calculation

Automatically calculate carry using detailed LPA terms and investor side letters. This ensures precise and transparent profit allocation.

Reporting

Our Reporting module is designed according to professional guidelines. You can be sure all investor requirements are met.

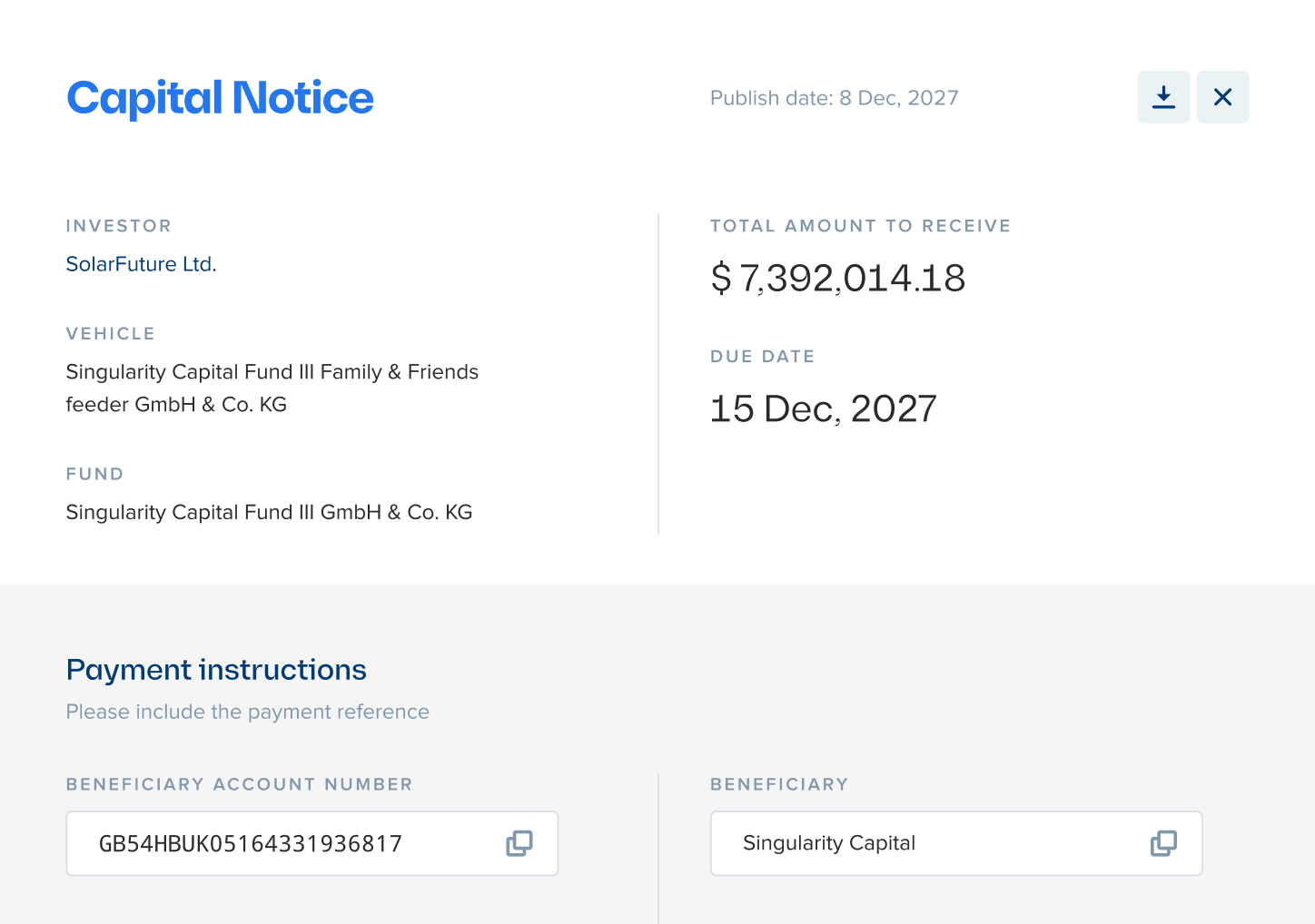

Capital notices

Create and issue capital calls or distributions — or combine them into a single netted notice. Each component is automatically allocated, across any structure.

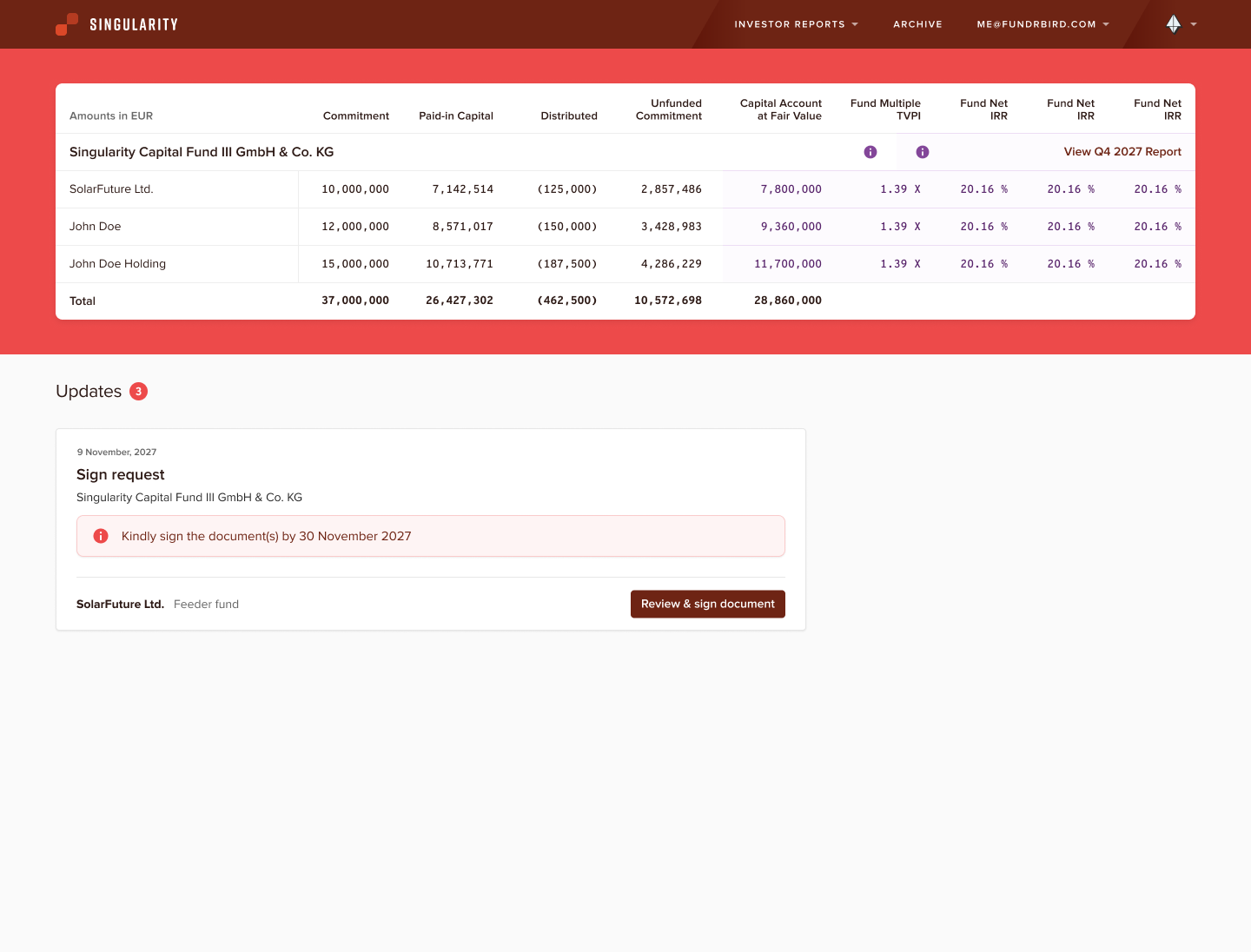

Capital account

Automatically calculates each investor’s full capital account using a single-entry system. This provides transparent views of commitments, capital activity and allocated P&L changes.

Performance calculations

Automatically compute the full suite of fund-level and portfolio-level performance metrics. This includes: Net IRR, Gross IRR, DPI, RVPI, TVPI and MOIC.

Investor report

Deliver guideline aligned quarterly investor reports. This includes: fund overview, performance, fees and carry, leverage details, portfolio summaries and investor capital accounts.

Portfolio

The Portfolio module makes it easy to organize portfolio information. Our system manages, collects and validates portfolio data.

Investment transaction tracking

Keep your complete investment record organized and accurate — capturing equity, debt, convertibles, escrows, liabilities and valuations.

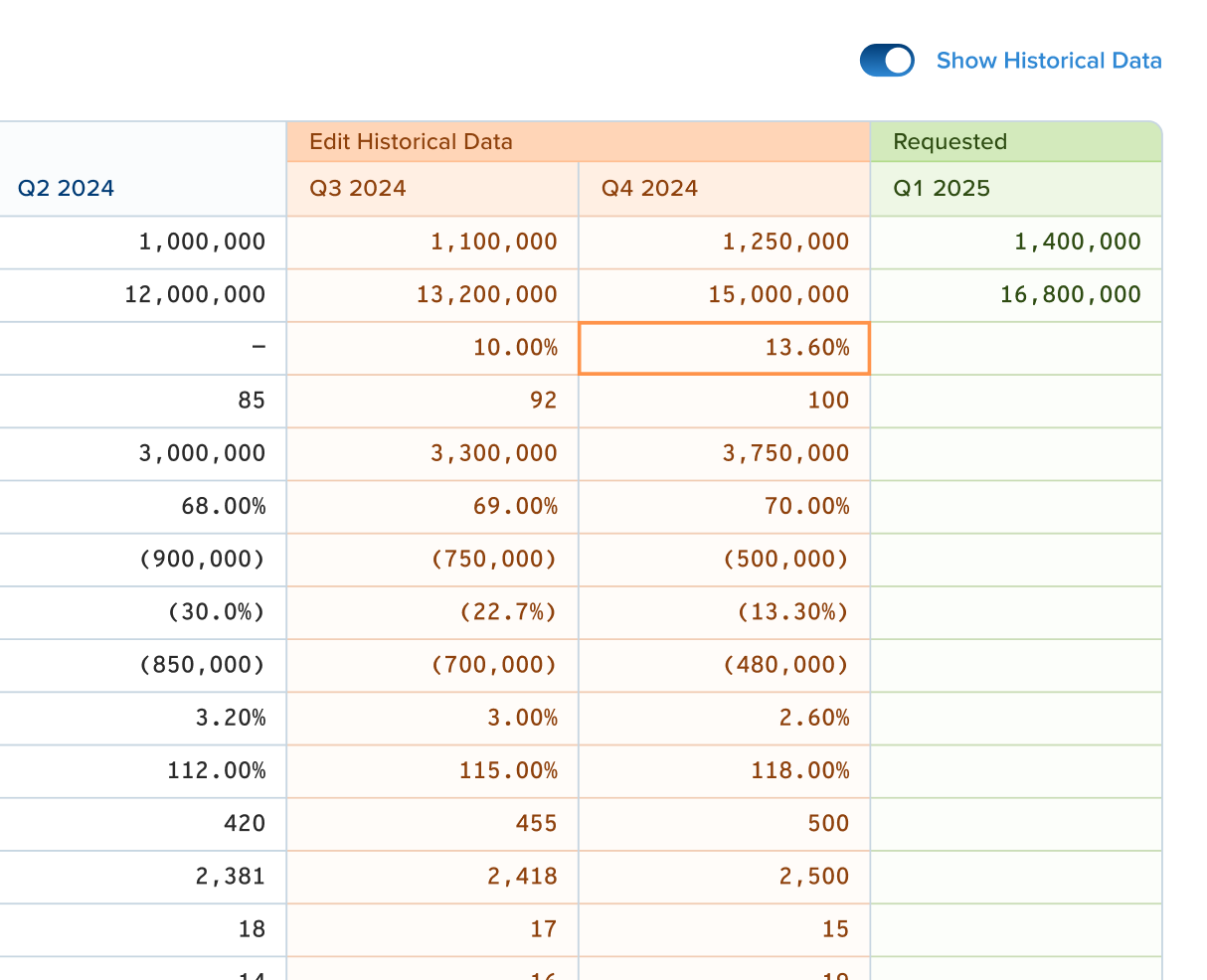

Automated data collection & controls

Schedule data requests, send automated reminders and apply custom validation rules. Manage edits and approvals with full real-time visibility.

AI-powered data ingestion

Extract portfolio metrics from PDFs and Excel files using advanced LLMs. Automatically flag discrepancies between newly submitted and existing data.

Reporting integration

Push selected metrics and reporting periods directly into the investor report’s asset detail pages. This eliminates manual data uploads and reduces operational errors.

AML compliance

Our AML compliance module provides audit ready compliance. All profiles are automatically screened every 24 hours against 1,500+ global databases.

Investor onboarding

KYC, AML and subscription document management are built-in. This streamlines the entire onboarding process.

Compliance monitoring

Continuously monitor compliance with regulatory standards. Alerts, a dashboard and audit-ready trails provide instant visibility and actionable insights.

Reporting

Generate regulator grade compliance reports with one click. This provides internal teams, auditors and investors with clear and traceable documentation.

Signing & voting

Enable digital voting and e-signatures for (A/E)GMs and investor resolutions. Every action is logged, timestamped and compliant with governance requirements.

Investor portal

Fundrbird provides your investors with a secure investor portal. This easy to use portal is branded with your firm’s visual identity across every touchpoint.

Streamlined interface

Deliver a modern, intuitive portal with clear data presentation, clean layouts and effortless navigation. Everything is optimized for both desktop and mobile.

Security

Enterprise-grade encryption, secure authentication and continuous monitoring ensure investor data remains protected at all times.

Investor monitoring

Gain visibility — see who has viewed key documents, notices and reports. This enables your team to follow up and ensure no communication is missed.

Branded Investor portal

Preview how customised colours align the investor portal with your fund’s branding. Here are some examples.

Admin portal

Via the Admin portal, you can manage all your fund operations from one place - even if you have a complex fund structure.

Cross-vehicle scalability

Manage all fund structures from a single Admin portal, purpose-built to scale smoothly across multiple investment vehicles.

Role-based access

Provide granular access for your team, fund administrators, auditors, and legal partners — enabling secure collaboration, full auditability, and controlled data access.

Structured data

Maintain fully structured data models that ensure consistency across funds, simplify extraction and support accurate downstream reporting.

API Integrations

Use the Fundrbird API to feed BI tools and AI models with clean, structured and well-organized data across your entire tech stack.

Coming soon

Fundrbird is committed to creating a complete fund ops suite. We will continue to add helpful features and flows based on client needs. In 10 years, our product will be just as relevant as it is today.

Our previous innovations

July 2025

Handle complexity with ease (Complex fund structures)

Main-parallel structures, nested feeders, multiple fund series and co-investments under one roof. Fundrbird supports even the most complex structures. Plus, we can handle the edge cases—excused investors, equalizations, complex waterfalls—without breaking your workflow.

July 2025

Turn your data into actionable intelligence (API for data extraction)

The future of fund ops is data-driven and AI-powered. But to get there, your data needs to be structured. Every feature we build helps you capture and structure your data. Our new API makes it easy to plug your data into any BI stack, dashboard or data warehouse.

July 2025

Seamless platform, say goodbye to silos (Compliance & digital onboarding)

If you need it all, Fundrbird has built it. LP onboarding, KYC/AML, fund accounting and investor reporting. We just added investor onboarding. So you have frictionless fund closings as part of a seamless back office workflow.

November 2025

AI portfolio data extraction

We’ve already streamlined portfolio data collection across all portfolio companies. Our AI portfolio data extraction feature transforms unstructured documents into structured, usable information.

November 2025

SEPA batch payments

We’ve added SEPA support for batch payment instructions. This makes investor distributions faster, more accurate and fully secure. With a single SEPA file, you can now process payments to all investors at once, directly through your bank.

November 2025

Waterfall calculations for complex use cases

Our updated waterfall add-on automates calculations for even the most complex distributions. This ensures accuracy and consistency. You can streamline workflows, accelerate timelines and eliminate manual errors.

How can we help you?

We’d love to hear from you. Explain your challenges to our sales rep in a 10 minute discovery call. Then together, we can explore the possibilities

If you decide to continue, the next step is to schedule a 30-minute demo.